Our board of directors has undertaken a review of its composition, the composition of its committees and the independence of directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, the board of directors has determined that none of Messrs. Young, Waite and Norden, Ms.Mss. Finney and George, and Drs. Galakatos, Hershberg,Foy, Kania, Malloy, and Malloy,Rollison, representing sevennine of our eightten directors, has a relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is an “independent director” as defined under the rules of The Nasdaq Stock Market. The board of directors also determined that the members of our audit committee, Ms.Mss. Finney and Messrs. Norden,George, Dr. Kania and Mr. Waite, and Young, the members of our compensation committee, Drs. Galakatos and Malloy and Mr.Foy and Messrs. Norden and Young, and the members of our nominating and corporate governance committee, Dr. Rollison and Messrs. Waite and Young, and Drs. Galakatos and Hershberg, satisfy the independence standards for those committees established by applicable SEC rules and the rules of The Nasdaq Stock Market. Effective April 26, 2019, our board of directors approved changes to the composition of the foregoing committees, which changes are discussed in the section titled “Proposal No. 1 - Election of Directors.”

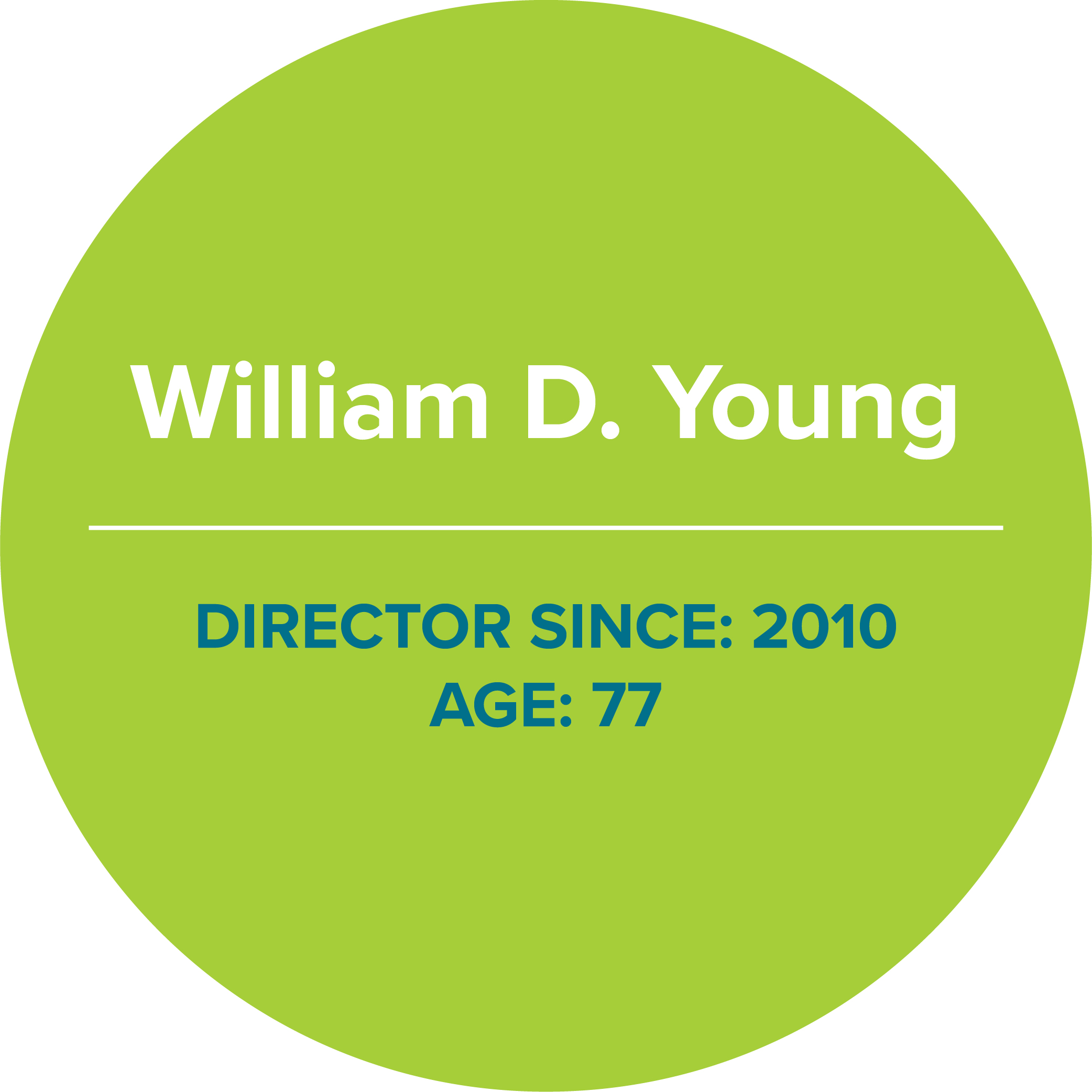

Mr. Young serves as the Chairman of the Board, and Mr. Gray serves as President and Chief Executive Officer of the Company.company. The roles of Chief Executive Officer and Chairman of the Board are currently separated in recognition of the differences between the two roles. We believe that it is in the best interests of our stockholders for the Board to make a determination regarding the separation or combination of these roles each time it elects a new Chairman or appoints a Chief Executive Officer, based on the relevant facts and circumstances applicable at such time. In June 2010, when Mr. Gray was first appointed President and Chief Executive Officer, theThe Board determinedbelieves it wasis in the best interests of the Companycompany to continue to maintain an independent Chairman to allow Mr. Gray to focus on his primary responsibility for the operational leadership and strategic direction of the Company.company. Our corporate governance guidelines provide that if our board of directors does not have an independent chairperson, the board of directors will appoint a lead independent director.

Although we do not have a formal policy regarding attendance by members of our board of directors at annual meetings of stockholders, we encourage, but do not require, directors to attend. FiveAll ten of our eightthen-serving directors attended our 20182021 annual meeting of stockholders.

Our board of directors has an audit committee, a compensation committee, and a nominating and corporate governance committee, each of which has the composition and responsibilities described below. Members serve on these committees until their resignation or until otherwise determined by our board of directors.

The nominating and corporate governance committee uses a variety of methods for identifying and evaluating director nominees. In its evaluation of director candidates, the nominating and corporate governance committee will consider the current size and composition of the board of directors and the needs of the board of directors and the respective committees of the board of directors. Some of the qualifications that the nominating and corporate governance committee considers include, without limitation, issues of character, integrity, judgment, diversity, age, independence, skills, education, expertise, business acumen, business experience, length of service, understanding of the Company’sour business and other commitments. Other than the foregoing, there are no stated minimum criteria for director nominees.

governance committee may take into account the benefits of diverse viewpoints. The nominating and corporate governance committee also considers these and other factors as it oversees the annual board of director and committee evaluations.

The board conducts an annual evaluation of its performance based in part on annual self-assessments completed by the board members. The chairperson ofIn December 2021, each director completed a written questionnaire with respect to the board together with our general counsel, conducts in-depth interviews withof directors and separate questionnaires for each board membercommittee of which they are a member. The questionnaires were previously approved by the nominating and corporate governance committee. The questionnaires are used to evaluate the board’s composition, culture, processes, and relationship with management as well as each board member’s view of his or her knowledge and understanding of our business and contributions to board deliberations. Each board member is also asked to identify areas where the board as a group and the board member individually could improve performance. Members of the board committees engage in assessing their respective committee’s performance during that year. These assessments are then aggregated and presented to the board and committees, who then determine what specific actions should be taken in response to this input. The Nominating and Corporate Governance committee is then responsible for ensuring that the recommended actions are implemented.

The nominating and corporate governance committee will consider candidates for directors recommended by stockholders so long as such recommendations comply with the certificate of incorporation and bylaws of our company and applicable laws, rules and regulations, including those promulgated by the SEC. The committee will evaluate such recommendations in accordance with its charter, our bylaws and the regular nominee criteria described above. This process is designed to ensure that the board of directors includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to our business. Eligible stockholdersStockholders wishing to recommend a candidate for nomination should contact our Corporate Secretary in writing. Such recommendations must include information about the candidate, a statement of support by the recommending stockholder, evidence of the recommending stockholder’s ownership of our stocknominee’s name and a signed letter from the candidate confirming willingness to servequalifications for membership on our board of directors. The committee has discretion to decide which individuals to recommend for nomination as directors.

A stockholder of record can nominate a candidate directly for election to the board of directors by complying with the procedures in Section 2.4(ii) of our bylaws. Any eligible stockholder who wishes to submit a nomination should review the requirements in the bylaws on nominations by stockholders. Any nomination should be sent in writing to NanoString Technologies, Inc., Attention: Corporate Secretary, 530 Fairview Avenue North, Seattle, WA 98109. For our 20202023 annual meeting of stockholders, notice must be received by us no earlier than February 11, 2020,13, 2023, and no later than March 12, 2020.

Stockholders wishing to communicate with a non-management member of the board of directors may do so by writing to such director, and mailing the correspondence to: NanoString Technologies, Inc., Attention: Corporate Secretary, 530 Fairview Avenue North, Seattle, WA 98109. AllOur Senior Vice President, Human Resources and Legal Affairs, in consultation with appropriate directors as necessary, will review all incoming communications and screen for communications that (1) are solicitations for products and services, (2) relate to matters of a personal nature not relevant for our stockholders to act on or for our board to consider and (3) matters that are of a type that render them improper or irrelevant to the functioning of our board or our business, for example, mass mailings, product complaints or inquiries, job inquiries, business solicitations and patently offensive or otherwise inappropriate material. If appropriate, our Senior Vice President, Human Resources and Legal Affairs, will route such stockholder communications will be forwarded to the appropriate committeedirector(s) or, if none is specified, then to the chairperson of the boardboard. These policies and procedures do not apply to communications to non-employee directors from our officers or non-management director.directors who are stockholders or stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act.

Our board of directors has adopted Corporate Governance Principles. These principles address, among other items, the responsibilities of our directors, the structure and composition of our board of directors and corporate governance policies and standards applicable to us in general. In addition, our board of directors has adopted a Code of Business Conduct that applies to all of our employees, officers and directors, including our Chief Executive Officer, Chief Financial Officer, and other executive and senior financial officers. The board of directors also has adopted a Code of Ethics that applies to our Chief Executive Officer, Chief Financial Officer and other senior financial officers. The full text of our Corporate Governance Principles, Code of Business Conduct and Code of Ethics is posted on the Corporate Governance portion of our website at http:https://investors.nanostring.com/corporate-governance.governance/governance-documents. We will post amendments to our Corporate Governance Principles, Code of Business Conduct and Code of Ethics or waivers of the same for directors and executive officers on the same website.

The board of directors has an active role, as a whole and also at the committee level, in overseeing the management of our risks. The board of directors is responsible for general oversight of risks and regular review of information regarding our risks, including market and technology risks, credit risks, cybersecurity, liquidity risks, ESG-related risks (including human capital management) and operational risks. The compensation committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements. The audit committee is responsible for overseeing the management of risks relating to accounting matters and financial reporting. The nominating and corporate governance committee is responsible for overseeing the management of risks associated with corporate governance, the independence of the board of directors and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board of directors is regularly informed through discussions with committee members about such risks. The board of directors believes that its leadership structure is consistent with the administration of its risk oversight function.

The following table provides information regarding compensation paid by us to our non-employee directors during 2018.2021. Directors who are also our employees receive no additional compensation for their service as a director. During 20182021 one director, Mr. Gray, our President and Chief Executive Officer, was an employee. Mr. Gray’s compensation is discussed under the caption “Executive Compensation.” We reimburse our directors for expenses associated with attending meetings of our board of directors and meetings of committees of our board. Dr. Teresa Foy joined our board in April 2022 and is not included in the table below.

| | | | | | | | | | | | | | |

(2)

| As of December 31, 2018, Mr. Young held options for the purchase of 125,178 shares of common stock, of which 115,010 shares were vested as of such date. |

| | |

(3)

| As of December 31, 2018, Ms. Finney held options for the purchase of 27,521 shares of common stock, of which 13,738 shares were vested as of such date. |

| | |

| l | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | | As of December 31, 2018, Dr. Galakatos held options for the purchase of 48,779 shares of common stock, of which 38,611 shares were vested as of such date. On April 8, 2019, Dr. Galakatos communicated his decision to the company not to stand for re-election at the 2019 annual meeting. |

| |

(5)

| As of December 31, 2018, Dr. Hershberg held options for the purchase of 41,545 shares of common stock, of which 31,377 shares were vested as of such date. |

| |

(6)

| As of December 31, 2018, Dr. Malloy held options for the purchase of 34,964 shares of common stock, of which 24,796 shares were vested as of such date. |

| |

(7)

| As of December 31, 2018, Mr. Norden held options for the purchase of 59,185 shares of common stock, of which 49,017 shares were vested as of such date. |

| |

(8)

| As of December 31, 2018, Mr. Waite held options for the purchase of 48,779 shares of common stock, of which 38,611 shares were vested as of such date. |

Director Compensation Program

Director Compensation PolicyDIRECTOR COMPENSATION POLICY

The director compensation policy that was in effect in 20182021 was adopted in connection with our initial public offering in June 2013 and has been amended from time to time. At the time ofThe philosophy underlying our initial public offering, the compensation committee retained Arnosti Consulting, Inc., or Arnosti Consulting, an independent compensation advisory firm, to provide recommendations to the nominating and corporate governance committee, or the NCG committee, on non-employee director compensation. Arnosti Consulting provided us with competitive data, analysis and recommendations regarding any appropriate updates to the non-employee director compensation policy previouslyprogram is to provide reasonable compensation to our non-employee directors that is appropriately aligned with our peers and is commensurate with the services and contributions of our non-employee directors. All directors will be reimbursed for expenses in place.their capacities as directors in accordance with our standard expense reimbursement policy. For purposes of the policy, each director is classified into one of the two following categories: (1) an “employee director,” is a director who is employed by us; and (2) a “non-employee director,” is a director who is not an employee director. Only non-employee directors receive compensation under the director compensation policy, which is provided in the form of equity and cash, as described below. Each year since 2019, the compensation committee's independent compensation consultant, Aon, has conducted a review of our director compensation policies and practices to advise on whether they are competitive with the market.

For 2018, both the cash component and the equity component remained in effect at 2017 levels. The philosophy underlyingEQUITY COMPENSATION

Annual Award

In connection with our 2021 annual meeting of stockholders, each non-employee director compensation program iswas eligible to provide reasonable compensationreceive annual equity grants valued at $210,000, consisting of time-based restricted stock units (“RSUs”), except that grants to our non-employee directors with less than 12 months of continuous service as of the annual shareholders meeting were prorated to reflect their applicable portion of a full year of service prior to such meeting. All of the shares underlying the annual equity grants will vest in full on the date that is appropriately aligned with our peers and is commensurate with the services and contributionsearlier of our non-employee directors. All directors will be reimbursed for expenses in their capacities as directors in accordance with our standard expense reimbursement policy. Dr. Galakatos, who servedthe one year anniversary of the date of grant or the date immediately prior to the next annual stockholders meeting, subject to continued service as a director through the vesting date, and subject to the change in 2018 andcontrol provisions of the company’s equity incentive plan, which are described below. The number of RSUs is not standing for re-election this year, iscalculated as follows, with the resulting number of RSUs subject to the award rounded down to the nearest whole share: (x) such approved value divided by (y) the average closing price of a senior managing director of Blackstone, which is a stockholdershare of our company through certain of its affiliated entities, and as a result of the internal policies of Blackstone, Dr. Galakatos is required to hold or remit any compensation received for his service on our board of directorscommon stock for the benefitperiod starting on the date that is 30 calendar days prior to the grant date and ending on (and inclusive of) the calendar day prior to such grant date.

Award upon First Joining the Board of Clarus Ventures or its affiliates.Directors

Equity Compensation

UnderUpon joining the policy, upon joining our board of directors, each non-employee director receivedis granted on his or her start date as a non-employee director an option to purchase 0.08% of our outstanding shares on the date of grant. This remains unchanged from the equity grant levels applicable to new non-employee directors under the policy as in effect in 2016 and 2017. The exercise price of the initial grant is the fair market value, as determined in accordance with our 2013 Equity Incentive Plan, on the date of the grant.RSUs valued at $375,000. The shares underlying the initial grant vest as to 50% of the total shares subject to such awardone-third each year over three years on the one year anniversary of the grant date, the director commenced services, and the remaining 50% of the total shares vest in 12 equal monthly installments thereafter, in each case, subject to continued service as a director through each vesting date.

Pursuantdate, and subject to the policy, atchange in control provisions of the beginningcompany’s equity incentive plan described below. The number of each fiscal year, each non-employee director is granted an option to purchase 0.04%RSUs will be determined by dividing the dollar value of our outstanding sharesthe grant by the average closing price of a share of company common stock for the period starting on the date that is 30 calendar days prior to the grant date and ending on (and inclusive of) the calendar day prior to such grant date.

Awards granted under the outside director compensation policy currently are granted pursuant to, and subject to the other terms and conditions of, grant. The exercise price of this annual grant is the fair market value, as determined in accordance with ourcompany’s 2013 Equity Incentive Plan. Under the company’s 2013 Equity Incentive Plan, on the date of the grant. All of the shares underlying the annual grant vest on the one year anniversary of the date of grant, subject to continued service as a director through the vesting date.

The vesting of each grant described above accelerates in fullto an outside director that is assumed or substituted in connection with a “change in control” as defined in our 2013 Equity Incentive Plan fully vests if the service of an outside director is terminated on or following a change in control, other than pursuant to a voluntary resignation of the director that is not at the request of the acquirer. Awards granted under the outside director compensation policy are granted pursuant to, and subject to the other terms and conditions of,In addition, our 2013 Equity Incentive Plan. Our 2013 Equity Incentive Plan provides that no non-employee director may be granted, in any fiscal year, stock-settled equity awards with a grant date fair value (determined in accordance with GAAP) of more than $500,000, with this limit increased to $1,000,000 in connection with his or her initial service, or cash-settled awards with a grant date fair value of more than $175,000, increased to $350,000 in connection with his or her initial service. If the new 2022 Equity Incentive Plan is approved by the stockholders at the Annual Meeting, then any equity awards granted under the outside director compensation policy on or following the date of that meeting will be pursuant to, and subject to the other terms and conditions of, the 2022 Equity Incentive Plan, including new fiscal year limits on outside director equity and cash retainers or annual or meeting fees for services as an outside director contained in the 2022 Equity Incentive Plan. However, the change in control-related acceleration provisions for non-employee director equity awards, which are similar to those contained in the 2013 Equity Incentive Plan, will be housed in the outside director compensation policy rather than in the 2022 Equity Incentive

For 2018, | | | | | | | | |

| 2022 PROXY STATEMENT | 27 | NanoString Technologies, Inc. |

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| l | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | | |

Plan. See Proposal No. 4 “Approval of the 2022 Equity Incentive Plan” in this proxy for additional details regarding this new equity incentive plan, which the board of directors is recommending that the stockholders approve.

2022 CHANGES TO EQUITY COMPENSATION

In February and March 2022, the compensation committee worked with Aon to perform the annual review of the director compensation program for competitiveness with the market. In connection with that review, the committee recommended that the board of directors increase the annual equity award values for non-employee directors in order to align the target percentile of peer group compensation for board members’ equity with the percentile used as a reference point for executive officer compensation. Accordingly, in April 2022, the board of directors amended the director compensation policy with respect to the annual equity awards such that, on the date of each year’s annual stockholders’ meeting, beginning in 2022, each non-employee director receivedwill receive an annual equity grant valued at $225,000, consisting of RSUs. The share calculation and the policies with respect to proration and vesting as described above for the annual awards are unchanged.

ACCELERATED AWARDS

Effective April 18, 2022, Dr. Hershberg resigned from the board of directors. In connection with Dr. Hershberg’s resignation from the board and in recognition of his service from June 2021 to mid-April 2022, the board approved the acceleration of vesting of 85% of Dr. Hershberg’s 3,890 unvested restricted stock units from his June 2021 annual director grant, which represents 3,306 restricted stock units, effective immediately prior to the effectiveness of his resignation as a director.

CASH COMPENSATION

Each non-employee director receives an annual cash retainer of $40,000 for serving on the board of directors, which we believe aligned with market practices and provided our non-employee directors with reasonable compensation commensurate with their service.directors. In addition to the annual retainer, the chairperson of the board of directors receivedreceives an additional cash retainer of $40,000, for 2018, and the chairpersons of the board’s audit committee, compensation committee and nominating and corporate governance committee wereare entitled to an additional cash retainer of $18,000, $12,000$20,000, $15,000 and $10,000 per year, respectively. Non-chair members of the audit committee, compensation committee and nominating and corporate governance committee wereare entitled to an additional cash retainer of $10,000, $7,500 $6,000 and $5,000 per year, respectively. As noted, the amount of the retainers remained the same as in 2017. All cash payments were paidare to be made in four equal installments at the end of each calendar quarter during which such individual served as a director (such payments to be prorated for service during a portion of such quarter).

STOCK OWNERSHIP GUIDELINES

2019 ChangesWe utilize stock ownership guidelines to Director Compensation Policy

In December 2018,strengthen the nominatingalignment of interests among stockholders, directors, and corporate governance committee retained Radford, an independent compensation consultant,other officers. The policy provides that our outside directors are expected to replace Arnosti Consulting. That same month,hold 3x their annual retainers for service on the board suspended the annual non-employee director grants that were scheduled to be issued on January 1, 2019, in order to allow for the completion of Radford's review of the director compensation policy and the implementation of any resulting equity compensation changes.

Radford conducted an extensive review of our director compensation policies and practices and conducted an extensive market analysis. Radford confirmed that director cash compensation generally is competitive to the market, although compensation to the chairs of our audit and compensation committees slightly lagged that provided by our peers. Based on its benchmarking of director equity, Radford reported that a number of our peer companies had begun using a blend of stock options and restricted stock units, rather than just stock options. Radford also found that the prevalent peer group practice was to use a target dollar value for setting equity awards rather than a percentage of outstanding company stock methodology. Based on these findings, and our philosophy of generally delivering equity value that falls between the 50th and 75th percentiles of peer company equity levels in order to reasonably compensate our non-employee directors for their service, the nominating and corporate governance committee recommended to our board of directors in January 2019 the following changes to director compensation, which were subsequently approved by the board:

Initial equity grant of stock options(not including retainers for newly elected or appointed directors will be granted automatically on their start dateserving as a non-employee director valued at $200,000 (described further below) and 1/3member or chair of any board committee) within five years from the later of the total will vest on each anniversary ofdate the grantpolicy was adopted and the date over three years, subject to continued service through each vesting date, andsuch outside director first becomes subject to the change in control provisions of our 2013 Equity Incentive Plan, which are described above; and

Annual equity grants to directors will be valued at $100,000 (described below), will be split equally (by value) between stock options and restricted stock units, and will be granted on the date of the annual stockholders' meeting each year. These equity grants will vest in full on the date that is the earlier of the one-year anniversary of the grant date, or the date immediately prior to the next annual stockholders meeting, subject to continued service through the vesting date, and subject to the change in control provisions of our 2013 Equity Incentive Plan, which are described above; and

Modest increasespolicy. See “Stock Ownership Guidelines” in the auditCompensation Disclosure and compensation committee chair retainers to align with the market 50th percentile.Analysis section of this proxy for additional details.

The number of options will be determined by dividing the dollar value of the grant by the Black Scholes value of a share and the number of restricted stock units will be determined by dividing the dollar value of the grant by the fair market value of a share, meaning the closing price of a share, of the company's common stock on the date of the grant. The exercise price of the initial and annual option grants is the fair market value, as determined in accordance with our 2013 Equity Incentive Plan, on the date of the grant.In light of the suspension of the scheduled January 1, 2019 annual equity grants to our non-employee directors pending Radford’s review of our director compensation policy, in March 2019, the board approved an interim option grant valued at $50,000 to each director. This grant will vest in full on the day prior to the date of the annual meeting of stockholders, June 18, 2019, subject to continued service as a director through the vesting date, and subject to the change in control provisions of our 2013 Equity Incentive Plan, which are described above. The regularly scheduled annual equity grants under the new director compensation policy described above will occur on the next day, the date of the annual meeting of stockholders, June 18, 2019.

| | | | | | | | |

| NanoString Technologies, Inc. | 28 | 2022 PROXY STATEMENT |

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENTRatification of Appointment of Independent Registered Public Accounting Firm

REGISTERED PUBLIC ACCOUNTING FIRMSUMMARY

The audit committee of the board of directors has appointed PricewaterhouseCoopersErnst & Young LLP independent registered public accountants, to audit our financial statements for the year ending December 31, 2019. During the year ended December 31, 2018, PricewaterhouseCoopers LLP(“EY”) served as our independent registered public accounting firm.

firm for the completion of our audit for the year ended December 31, 2021. In April 2022, the audit committee approved the appointment of EY as our independent registered public accounting firm for the year ending December 31, 2022, and our board of directors has further directed that we submit the selection of our independent registered public accounting firm for 2022 for ratification by the stockholders at the Annual Meeting. Notwithstanding its selection and even if our stockholders ratify the selection, our audit committee, in its discretion, may appoint another independent registered public accounting firm at any time during the year if the audit committee believes that such a change would be in the best interests of NanoString Technologies, Inc. and its stockholders. At the annual meeting of stockholders,Annual Meeting, the stockholders are being asked to ratify the appointment of PricewaterhouseCoopers LLPEY as our independent registered public accounting firm for the year ending December 31, 2019.2022. Our audit committee is submitting the selection of PricewaterhouseCoopers LLPEY to our stockholders because we value our stockholders’ views on our independent registered public accounting firm and as a matter of good corporate governance. Representatives of PricewaterhouseCoopers LLPEY will be present virtually at the Annual Meeting, and they will have an opportunity to make statements and will be available to respond to appropriate questions from stockholders.

IfCHANGE IN INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

On March 16, 2020, the audit committee approved the dismissal of PricewaterhouseCoopers LLP (“PwC”), as our independent registered public accounting firm effective March 16, 2020. EY’s engagement as our independent registered public accounting firm was effective March 19, 2020. Our stockholders do not ratifyratified the appointment of PricewaterhouseCoopersEY at last year’s annual stockholders meeting on June 16, 2021.

Information about Ernst & Young LLP

On March 16, 2020, the audit committee may reconsiderapproved the appointment.

Feesappointment of EY as our new independent registered public accounting firm, effective March 19, 2020 and the appointment was ratified by stockholders on June 16, 2020. During our fiscal years ended December 31, 2019 and 2018, and the subsequent interim period through March 19, 2020, neither we nor anyone acting on our behalf consulted with EY regarding any of the Independent Registered Public Accounting Firmmatters described in Items 304(a)(2)(i) and (ii) of Regulation S-K.

EY’s reports on our financial statements and internal control over financial reporting for the year ended December 31, 2021 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope, or accounting principles.

Information about PricewaterhouseCoopers LLP

PwC’s reports on our financial statements for the years ended December 31, 2019 and 2018 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope, or accounting principles.

During our two fiscal years ended December 31, 2019 and 2018 and the subsequent interim period through March 16, 2020, there were no disagreements, within the meaning of Item 304(a)(1)(iv) of Regulation S-K promulgated under the Exchange Act (“Regulation S-K”) and the related instructions thereto, with PwC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of PwC, would have caused it to make reference to the subject matter of the disagreements in connection with its reports.

| | | | | | | | |

| 2022 PROXY STATEMENT | 29 | NanoString Technologies, Inc. |

During our fiscal years ended December 31, 2019 and 2018 and the subsequent interim period through March 16, 2020, except as noted below, there were no reportable events within the meaning of Item 304(a)(1)(v) of Regulation S-K and the related instructions thereto. As disclosed in our Annual Report on Form 10-K for the year ended December 31, 2018 filed with the SEC on March 11, 2019 (“2018 Annual Report”), we identified a material weakness related to an ineffective control environment resulting from not having sufficient resources with an appropriate level of information technology controls knowledge, expertise and training commensurate with our financial reporting requirements. This material weakness contributed to additional material weaknesses in that we did not design and maintain effective information technology general controls, as well as certain controls related to creating and posting journal entries. As disclosed in our Annual Report on Form 10-K for the year ended December 31, 2019 filed with the SEC on March 2, 2020 (the “2019 Annual Report”), we identified material weaknesses related to an ineffective control environment resulting from not having sufficient resources with an appropriate level of controls knowledge, expertise and training commensurate with our financial reporting requirements. The deficiencies in the control environment contributed to additional material weaknesses in that we did not design and maintain effective information technology general controls, as well as certain controls related to creating and posting journal entries, as well as controls related to customer order entry, price and quantity during the product and services billing and revenue processes, and controls related to periodic inventory counts, receiving of inventory, and recording adjustments to inventory quantities. The subject matter of these reportable events was discussed by the audit committee with PwC. We authorized PwC to respond fully to the inquiries of EY concerning the subject matter of the reportable events.

We provided PwC with a copy of a Current Report on Form 8-K (the “Form 8-K”), which was filed with the SEC on March 20, 2020, and requested that PwC furnish us with a letter addressed to the SEC stating whether PwC agreed with the disclosures in the Form 8-K and, if not, stating the respects in which it did not agree. We received the requested letter from PwC and a copy of the letter, dated March 20, 2020, was filed as Exhibit 16.1 to the Form 8-K and such letter is incorporated by reference herein.

FEES OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The following table summarizes the fees billed or to be billed by PricewaterhouseCoopers LLP,EY, our independent registered public accounting firm, for the years ended 20182021 and 2017.2020.

| | | | | | | | |

| | Year Ended December 31, |

| Fee Category | 2021 | 2020 |

| | |

Audit fees(1) | $ | 2,097,000 | | $ | 2,140,149 | |

| Audit-related fees | — | | — | |

| Tax fees | — | | — | |

All other fees(2) | 5,790 | | — | |

| Total fees | $ | 2,102,790 | | $ | 2,140,149 | |

|

| | | | | | | |

| | Year Ended December 31, |

| Fee Category | 2018 | | 2017 |

Audit fees (1) | $ | 2,651,523 |

| | $ | 1,113,568 |

|

| Audit-related fees | — |

| | — |

|

| Tax fees | — |

| | — |

|

All other fees (2) | 62,771 |

| | 161,819 |

|

| Total fees | $ | 2,714,294 |

| | $ | 1,275,387 |

|

2.All other fees include any fees billed that are not audit, audit-related, or tax fees. In 2021, these fees related primarily to accounting research software.

| |

(1)

| Audit fees relate to professional services provided in connection with the audit of our annual consolidated financial statements, review of our quarterly consolidated financial statements and our public offerings. In 2018, audit fees also relate to the audit of internal control over financial reporting. |

| |

(2)

| All other fees include any fees billed that are not audit, audit related, or tax fees. In 2018 and 2017, these fees related primarily to professional services provided in connection with the review of internal controls, processes and related systems over financial reporting designed by management, in addition to fees related to accounting research software. |

Auditor IndependenceAUDITOR INDEPENDENCE

In 2018,2021, there were no other professional services provided by PricewaterhouseCoopers LLPEY that would have required the audit committee to consider their compatibility with maintaining the independence of PricewaterhouseCoopers LLP.EY.

Audit Committee Policy on Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting FirmAUDIT COMMITTEE POLICY ON PRE-APPROVAL OF AUDIT AND PERMISSIBLE NON-AUDIT SERVICES OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

| | | | | | | | |

| NanoString Technologies, Inc. | 30 | 2022 PROXY STATEMENT |

Pursuant to its charter, the audit committee must review and approve, in advance, the scope and plans for the audits and the audit fees and approve in advance (or, where permitted under the rules and regulations of the SEC, subsequently) all non-audit services to be performed by the independent auditor that are not otherwise prohibited by law and any associated fees. The audit committee may delegate to one or more members of the committee the authority to pre-approve audit and permissible non-audit services, as long as this pre-approval is presented to the full committee at scheduled meetings. In accordance with the foregoing, the committee has delegated to the chair of the audit committee the authority to pre-approve services to be performed by our independent registered public accounting firm and associated fees, provided that the chair is required to report any decision to pre-approve such audit-related or non-audit services and fees to the full audit committee for ratification at its next regular meeting. All fees paid to PricewaterhouseCoopers LLPEY for our fiscal year 20182021 were pre-approved by our audit committee or pre-approved by our audit chair and subsequently ratified by the audit committee.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERSERNST & YOUNG LLP.

| | | | | | | | |

| 2022 PROXY STATEMENT | 31 | NanoString Technologies, Inc. |

PROPOSAL NO. 3

ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS ("SAY-ON-PAY"Advisory Vote on Compensation of Named Executive Officers (“Say-On-Pay”)

PursuantAt our 2019 annual meeting of stockholders, our board of directors recommended and our stockholders approved holding a non-binding advisory vote on the compensation of our named executive officers every one year. Accordingly, pursuant to Section 14A of the Exchange Act and in accordance with SEC rules, we are providing our stockholders with the opportunity to vote at the annual meeting of stockholdersAnnual Meeting on this advisory or non-binding resolution regarding the compensation of our named executive officers (commonly referred to as “say-on-pay”). This say-on-pay proposal gives our stockholders the opportunity to express their views on the compensation of our named executive officers as a whole. This vote is not intended to address any specific item of compensation or any specific named executive officer, but rather the overall compensation of all of our named executive officers and the philosophy, policies and practices described in this proxy statement. Because the vote on this proposal is advisory in nature, it will not affect any compensation already paid or awarded to our named executive officers and will not be binding on us, the board of directors or the compensation committee. The say-on-pay vote will, however, provide information to us regarding investor sentiment about our executive compensation philosophy, policies, and practices, which the compensation committee will be able to consider when determining executive compensation for the remainder of the current fiscal year and beyond.

For more information about the compensation that we paid to our named executive officers during 2018,2021, as well as a description of our overall executive compensation philosophy and program, please refer to the “Executive Compensation” sections of this Proxy Statement, which we believe demonstratesdemonstrate that our executive compensation program was designed appropriately and is working to ensure management'smanagement’s interests are aligned with our stockholders'stockholders’ interests to support long-term value creation. Accordingly, we ask our stockholders to vote "FOR"“FOR” the following advisory resolution at the 2019 annual meeting of stockholders:2022 Annual Meeting:

"“RESOLVED, that the stockholders of NanoString Technologies, Inc. approve, on a non-binding advisory basis, the compensation of the named executive officers, as disclosed in this Proxy Statement for 2019the 2022 Annual Meeting of Stockholders, including the accompanying compensation tables and related narrative discussion, and other related disclosures."”

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION.

| | | | | | | | |

| NanoString Technologies, Inc. | 32 | 2022 PROXY STATEMENT |

PROPOSAL NO. 4

ADVISORY VOTE ON FREQUENCY OF ADVISORY VOTES ON EXECUTIVE OFFICER COMPENSATIONApproval of the 2022 Equity Incentive Plan

Stockholders haveOur stockholders are being asked to approve a new 2022 Equity Incentive Plan (the “Plan”). Our current stockholder-approved equity plan, the opportunity2013 Equity Incentive Plan (the “2013 Plan”), currently is set to advise theexpire in 2023. Our board of directors has adopted the Plan, subject to approval from our stockholders at the Annual Meeting. If our stockholders approve the Plan, it will immediately replace the 2013 Plan, and the 2013 Plan will terminate immediately, and no further awards will be made under the 2013 Plan, but the 2013 Plan will continue to govern awards previously granted under it. If our stockholders do not approve the Plan, the 2013 Plan will remain in a non-binding vote, whether we should conduct an advisory (non-binding) vote to approve named executive officer compensation (that is, votes similar toeffect through the non-binding vote in Proposal No. 3 above) every one, two or three years.

While our compensation strategies are related to both the short-term and longer-term business outcomes, we realize that compensation decisions are made annually. We also believe that an annual advisory vote on named executive officer compensation will allow stockholders to provide us with more frequent direct feedback on our compensation disclosures and named executive officer compensation program.remainder of its term. The board of directors has determined that holding an advisory vote onit is in the best interests of the company to adopt the Plan and is asking our stockholders to approve the Plan. The company’s named executive officer compensation every year isofficers and directors have an interest in this proposal as they are eligible to receive equity awards under the most appropriate policyPlan.

PROPOSAL

We have historically provided stock options, restricted stock units and other types of equity awards as an incentive to our employees, directors and consultants to promote increased stockholder value. The board of directors and management believe that stock options, restricted stock units and other types of equity awards are one of the primary ways to attract and retain key personnel responsible for us at this time,the continued development and recommends that stockholders vote for future advisory votes on named executive officer compensationgrowth of our business, and to occur each year.motivate all employees to increase stockholder value. In addition, stock options, restricted stock units and other types of equity awards are considered a competitive necessity in the life sciences and biotechnology industries in which we compete.

The frequencyboard of directors believes that receives the highestcompany must offer a competitive equity incentive program if it is to continue to successfully attract and retain the best possible candidates for positions of substantial responsibility within the company. We intend to use this new plan to continue our current practice of granting equity or cash-settled awards to all of our employees worldwide. From March 2021 until March 31, 2022, our global workforce expanded by approximately 200 employees to a total headcount of approximately 790. The board of directors expects that the Plan will be an important factor in continuing to attract, retain and reward high caliber employees who are essential to our success and in providing incentive to these individuals to promote the success of the company.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE 2022 EQUITY

INCENTIVE PLAN.

HIGHLIGHTS OF THE 2022 EQUITY INCENTIVE PLAN

The following number of votes castshares of our common stock will be deemedreserved for issuance under the Plan: (i) 2,500,000 shares, plus (ii) (A) any shares that, as of immediately before the termination or expiration of the 2013 Plan, have been reserved but not issued under any awards granted under the 2013 Plan and are not subject to beany awards granted thereunder, plus (B) any shares subject to awards granted under the frequency selected2013 Plan that, after the 2013 Plan is terminated or expired, expire or otherwise terminate without having been exercised or issued in full or are forfeited to or repurchased by the stockholders. Becausecompany due to failure to vest, with the maximum number of shares that may be added to the Plan under clause (ii) above equal to 6,814,978 shares.

| | | | | | | | |

| 2022 PROXY STATEMENT | 33 | NanoString Technologies, Inc. |

The Plan includes several features that are consistent with protecting the interests of our stockholders and sound corporate governance practices. These features are highlighted below, and are more fully described in the summary of the Plan further below in this voteproposal.

•No Evergreen. The Plan does not include an “evergreen” or other provision that provides for automatic increases in the number of shares available for grant under the Plan.

•No Repricing or Exchange of Awards. The Plan prohibits us from instituting a program to reduce the exercise price of outstanding awards or surrender or cancel outstanding awards for new awards and/or cash.

•No Discounted Options or SARs. All options and SARs must have an exercise or measurement price that is advisory, itat least equal to the fair market value of the underlying common stock on the date of grant.

•No Dividend on Unexercised Options or SARs. No dividends or other distributions will be paid with respect to shares that are subject to unexercised stock options or stock appreciation rights (“SARs”).

•Dividends on Restricted Stock, Restricted Stock Units, Performance Units and Performance Shares Not Paid Until Award Vests. Dividends or other distributions payable with respect to shares subject to these awards will not be bindingpaid before and unless the underlying shares vest.

•Limit on Non-Employee Director Compensation. In any fiscal year, non-employee directors may not be granted awards and be provided cash retainers or annual or meeting fees for service as a non-employee director in amounts that collectively exceed the limits contained in the Plan.

•No Automatic Vesting of Awards in a Change in Control. The Plan does not provide for the automatic vesting of awards in connection with a change in control where a successor corporation assumes the awards. Instead, the Plan allows the Administrator (as defined below) to determine the treatment of awards in connection with a change in control, provided that if the successor corporation does not assume or substitute for an award, the award will fully vest. The Plan is administered by a committee of independent directors.

•Awards May Be Subject to Clawback. Each award under the Plan will be subject to reduction, cancellation, forfeiture, recoupment, reimbursement, or reacquisition under any clawback policy that we are required to adopt under the listing standards of any national securities exchange or association on which our securities are listed or as is otherwise required by applicable laws, and the Administrator may require a participant to forfeit, return or reimburse us all or a portion of the award and any amounts paid under the award, according to such clawback policy or in order to comply with applicable laws.

CONSIDERATIONS OF THE BOARD OF DIRECTORS IN MAKING ITS RECOMMENDATION

After the consideration and input of our compensation committee, our board of directors. However,directors approved the Plan and the number of shares of our common stock reserved under the Plan. The number of shares reserved under the Plan is proposed in order to give the board of directors and the compensation committee continued flexibility to grant stock options, restricted stock units and other types of equity awards.

The board of directors and management believe that granting equity awards motivates higher levels of performance, aligns the interests of employees and stockholders by giving employees the perspective of owners with equity stakes in the company, and provides an effective means of recognizing employee contributions to our success. The board of directors and management also believe that equity awards are of great value in recruiting and retaining highly qualified technical and other key personnel who are in great demand, as well as rewarding and encouraging current employees and other service providers. Finally, the board of directors and management believe that the ability to grant equity awards will considerbe important to our future success by helping us to accomplish these objectives.

| | | | | | | | |

| NanoString Technologies, Inc. | 34 | 2022 PROXY STATEMENT |

If our stockholders approve the outcomePlan, we currently anticipate that the shares available under the Plan will be sufficient to meet our expected needs through 2023, depending on a variety of factors, including, but not limited to, stock price, hiring, and long-term incentive compensation mix. In determining the number of shares to be reserved for issuance under the Plan, the compensation committee and the board of directors also considered the following:

•Remaining Competitive by Attracting/Retaining Talent. As discussed above, the compensation committee and the board of directors considered the importance of an adequate pool of shares to attract, retain and reward our high-performing employees, especially since we compete with many biotechnology companies for a limited pool of talent. The company currently maintains the 2018 Inducement Equity Incentive Plan (the “Inducement Plan”) in addition to the 2013 Plan. The Inducement Plan is limited to grants made as a material inducement for new employment (or employment after a bona fide period of non-employment) with the company. Therefore, although the Inducement Plan is quite helpful in our efforts to grant new hire awards that may attract talent to the company, it is not sufficient for all our hiring, retention and compensation needs.

•Historical Grant Practices. The compensation committee and the board of directors considered the historical amounts of equity awards that we have granted in the past three years. In fiscal years 2021, 2020, and 2019, we granted equity awards representing a total of 3,383,238 shares.

•Forecasted Grants. As discussed above, the compensation committee and the board of directors anticipate that the proposed share reserve, based on projected share utilization will be sufficient for our equity award usage through at least 2023. In determining the projected share utilization, the compensation committee and the board of directors considered a forecast that included the following factors: (i) the approximately 3,119,676 unissued shares remaining under the 2013 Plan as of the stockholder vote, along with other relevant factors, in recommending a voting frequency to ourdate of the initial action by the board of directors.

You may cast your vote by choosing the option of one year, two years, three years, or abstain from voting in response to the resolution set forth below:

“RESOLVED, that the option of once every year, two years, or three years that receives the highest number of votes cast for this resolution will be determined to be the preferred frequency with which NanoString Technologies, Inc. is to hold an advisory vote by stockholdersdirectors to approve the Plan; (ii) the anticipated growth in our employee base; (iii) the approximately 7,171 unissued shares remaining under the Inducement Plan as of the date of the initial action by the board of directors to approve the Plan, and the limited nature of the grants that may be awarded under the Inducement Plan; (iv) the additional 2,500,000 shares that would be available for grant under the Plan, if the stockholders approve the Plan; and (v) the estimated cancellations and forfeitures returned back to the 2013 Plan.

•Proxy Advisory Firm Guidelines. Because of our significant institutional stockholder base, the compensation committee and the board of named executivedirectors also considered the relevant guidelines from proxy advisory firms. Our three-year average burn rate and the dilution relating to the initial share reserve is within such guidelines.

SUMMARY OF THE 2022 EQUITY INCENTIVE PLAN

The following is a summary of the principal features of the Plan and its operation. The summary is qualified in its entirety by reference to the Plan as set forth in Appendix A.

General

The purposes of the Plan are to attract and retain the best available personnel for positions of substantial responsibility, to provide additional incentive to employees, directors and consultants who perform services to the company, and to promote the success of the company’s business. These incentives are provided through the grant of stock options, restricted stock, restricted stock units, stock appreciation rights, performance units, and performance shares.

Authorized Shares

Subject to the adjustment provisions contained in the Plan, stockholders are being asked to approve the reservation of the following number of shares of our common stock for issuance under the Plan: (i) 2,500,000 shares, plus (ii) (A) any shares that, as of immediately before the termination or expiration of the 2013 Plan, have been reserved but not issued under any awards granted under the 2013 Plan and are not subject to any awards granted thereunder, plus (B) any shares subject to awards granted under the 2013 Plan that, after 2013 Plan is terminated or expired, expire or otherwise terminate without having been exercised or issued in full or are forfeited to or repurchased by the company due to failure to vest, with the maximum number of shares that may be added to

| | | | | | | | |

| 2022 PROXY STATEMENT | 35 | NanoString Technologies, Inc. |

the Plan under clause (ii) above equal to 6,814,978 shares. In addition, shares may become available for issuance under the Plan as described in the next paragraph. The shares may be authorized, but unissued, or reacquired common stock. As of April 21, 2022, the number of shares subject to awards outstanding under the 2013 Plan and the 2004 Stock Option Plan was 3,674,107 shares.

If any award granted under the Plan expires or becomes unexercisable without having been exercised in full, or, with respect to restricted stock, restricted stock units, performance units or performance shares, is forfeited to or repurchased by the company due to failure to vest, then the unpurchased or forfeited or repurchased shares subject to such award will become available for future grant or sale under the Plan (unless the Plan has terminated). With respect to stock appreciation rights, only shares actually issued (i.e., the net shares issued) pursuant to a stock appreciation right will cease to be available under the plan; all remaining shares under stock appreciation rights will remain available for future grant or sale under the plan (unless the plan has terminated). If shares issued under restricted stock, restricted stock units, performance shares or performance units are repurchased by or forfeited to the company due to failure to vest, such shares will become available for future grant under the Plan. Shares acquired pursuant to Awards used to pay the exercise price or purchase price of an award or to satisfy the tax withholding obligations of an award will become available for future grant or sale under the Plan. If an award is paid out in cash rather than shares, the number of shares available for issuance under the Plan will not be reduced. Shares repurchased by the company on the open market using the proceeds from the exercise of an award will not become available for future grant under the Plan.

Adjustments to Shares subject to the Plan

In the event of any dividend or other distribution (whether in the form of cash, shares, other securities, or other property), recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, reclassification, repurchase, or exchange of shares or other securities of the company, or other change in the corporate structure affecting our common stock occurs (other than any ordinary dividends or other ordinary distributions), the Administrator, in order to prevent diminution or enlargement of the benefits or potential benefits intended to be made available under the Plan, will adjust the number and class of shares of stock that may be delivered under the Plan, and/or the number, class and price of shares of stock subject to outstanding awards, and the numerical share limits in the Plan.

Administration

The Plan will be administered by the board of directors, any committee of the board of directors, or a committee of individuals satisfying applicable laws appointed by the board of directors or a duly authorized committee of the board of directors in accordance with the terms of the Plan (the “Administrator”). In the case of transactions, including grants to certain officers and key employees of the company, intended to qualify, as exempt under Rule 16b-3 of the Securities Exchange Act of 1934 (the “Exchange Act”), the members of the committee must qualify as “non-employee directors” under Rule 16b‑3 of the Exchange Act.

Subject to the terms of the Plan, the Administrator has the authority to interpret and administer the Plan, including but not limited to, the authority, in its discretion, to select the employees, consultants, and directors who will receive awards, to determine the terms and conditions of awards, to modify or amend each award (subject to the restrictions of the Plan), including to accelerate vesting or waive forfeiture restrictions, to extend the post-service exercise period applicable to an award, and to interpret the provisions of the Plan and outstanding awards. The Administrator may allow a participant to defer the receipt of payment of cash or delivery of shares that otherwise would be due to such participant. The Administrator may make rules and regulations relating to sub-plans established for the purpose of facilitating compliance with applicable non-U.S. laws, easing administration of the Plan, or qualifying for favorable tax treatment under applicable non-U.S. laws and may make all other determinations deemed necessary or advisable for administering the Plan. The Administrator may temporarily suspend the exercisability of an award if the Administrator deems such suspension to be necessary or appropriate for administrative purposes or to comply with applicable laws, provided that such suspension must be lifted before the expiration of the maximum term and post-service exercisability period of an award, unless doing so would not comply with applicable laws. The Administrator may not institute an exchange program under which (i) outstanding awards are surrendered or cancelled in exchange for awards of the same type (which may have a higher or lower exercise price and/or different terms), awards of a different type and/or cash, (ii) which participants have the opportunity to transfer outstanding awards to a financial institution, or (iii) the exercise price of an outstanding award is reduced.

| | | | | | | | |

| NanoString Technologies, Inc. | 36 | 2022 PROXY STATEMENT |

Eligibility

Awards may be granted to employees, directors and consultants of the company and employees and consultants of any parent or subsidiary corporation of the company. Incentive stock options may be granted only to employees who, as of the time of grant, are employees of the company or any parent or subsidiary corporation of the company. As of April 21, 2022, approximately 777 employees, 10 non-employee directors, and 15 consultants were eligible to participate in the Plan. As of the same date, the closing price of a share of our common stock as reported on The Nasdaq Global Market was $19.75.

Stock Options

Each option granted under the Plan will be evidenced by a written or electronic agreement between the company and a participant specifying the number of shares subject to the option and the other terms and conditions of the option, consistent with the requirements of the Plan.

The exercise price per share of each option may not be less than the fair market value of a share of our common stock on the date of grant. However, an exception may be made for any options that are granted in substitution for options held by employees of companies that the company acquires in a manner consistent with Section 424(a) of the Code. In addition, any incentive stock option granted to an employee who, at the time of grant, owns stock representing more than 10% of the total combined voting power of all classes of stock of the company or any parent or subsidiary corporation of the company (a “Ten Percent Stockholder”) must have an exercise price per share equal to at least 110% of the fair market value of a share on the date of grant. The aggregate fair market value of the shares (determined on the grant date) covered by incentive stock options that first become exercisable by any participant during any calendar year also may not exceed $100,000. Generally, the fair market value of our common stock is the closing price of our stock on any established stock exchange or national market system on the applicable date.

The Plan provides that the Administrator will determine the acceptable form(s) of consideration for exercising an option. An option will be deemed exercised when the company receives the notice of exercise and full payment for the shares to be exercised, together with any applicable tax withholdings.

Options will be exercisable at such times or under such conditions as determined by the Administrator and set forth in the award agreement. The maximum term of an option will be specified in the award agreement but will not be more than 10 years, provided that an incentive stock option granted to a Ten Percent Stockholder must have a term not exceeding 5 years.

The Administrator will determine and specify in each award agreement, and solely in its discretion, the period of exercise applicable to each option following a service provider’s cessation of service. In the absence of such a determination by the Administrator, the participant generally will be able to exercise his or her option for (i) 3 months following his or her cessation of service for reasons other than death or disability, and (ii) 12 months following his or her cessation of service due to disability or following his or her death while holding the option. An award agreement may provide for an extension of a post-service exercise period upon a cessation of service for reasons other than death or disability if the exercise of the option following such cessation of service would result in liability under Section 16(b) of the Exchange Act or would violate the registration requirements under the Securities Act.

Restricted Stock Awards

Awards of restricted stock are rights to acquire or purchase shares, which vest in accordance with the terms and conditions established by the Administrator in its sole discretion. Each restricted stock award granted will be evidenced by a written or electronic agreement between the company and the participant specifying the number of shares subject to the award and the other terms and conditions of the award, consistent with the requirements of the Plan. Restricted stock awards may be subject to vesting conditions if and as the Administrator specifies, and the shares acquired may not be transferred by the participant until vested. The Administrator may set restrictions based upon continued employment or service, the achievement of specific performance objectives (company-wide, departmental, divisional, business unit or individual), applicable federal or state securities laws, or any other basis determined by the Administrator in its discretion.

| | | | | | | | |

| 2022 PROXY STATEMENT | 37 | NanoString Technologies, Inc. |

Unless otherwise provided by the Administrator, a participant will forfeit any shares of restricted stock as to which the restrictions have not lapsed before the participant’s cessation of service. Unless the Administrator provides otherwise, and subject to the general rules in the Plan related to dividends (described below), participants holding restricted stock will have the right to vote the shares and to receive any dividends paid, except that dividends or other distributions paid in shares will be subject to the same restrictions on transferability and forfeitability as the underlying shares and dividends or other distributions payable with respect to shares subject to awards will not be paid before and unless the underlying shares vest. The Administrator may, in its sole discretion, reduce or waive any restrictions and may accelerate the time at which any restrictions will lapse or be removed.

Restricted Stock Units

The Administrator may grant restricted stock units which represent a right to receive shares at a future date as set forth in the proxy statementparticipant’s award agreement. Each restricted stock unit granted under the Plan will be evidenced by a written or electronic agreement between the company and the participant specifying the number of shares subject to the award and other terms and conditions of the award, consistent with the requirements of the Plan. Restricted stock units may be settled, in the sole discretion of the Administrator, in shares, cash or a combination of both.

Restricted stock units will result in a payment to a participant only if the performance goals or other vesting criteria (if any) the Administrator may establish are achieved or the awards otherwise vest. The Administrator may set vesting criteria based upon continued employment or service, the achievement of specific performance objectives (company-wide, departmental, divisional, business unit, or individual goals (including, but not limited to, continued employment or service)), applicable federal or state securities laws or any other basis determined by the Administrator in its discretion, which, depending on the extent to which they are met, will determine the number of restricted stock units to be paid out to participants.

After the grant of a restricted stock unit award, the Administrator, in its sole discretion, may reduce or waive any vesting criteria that must be met to receive a payout and may accelerate the time at which any restrictions will lapse or be removed. A participant will forfeit any unearned restricted stock units as of the date set forth in the award agreement. The Administrator in its sole discretion may pay earned restricted stock units in cash, shares of our common stock, or a combination of cash and shares.

Stock Appreciation Rights

A stock appreciation right gives a participant the right to receive the appreciation in the fair market value of our common stock between the date of grant of the award and the date of its exercise. Each stock appreciation right granted under the Plan will be evidenced by a written or electronic agreement between the company and the participant specifying the exercise price and the other terms and conditions of the award, consistent with the requirements of the Plan.

The exercise price per share of each stock appreciation right may not be less than the fair market value of a share on the date of grant. Upon exercise of a stock appreciation right, the holder of the award will be entitled to receive an amount determined by multiplying (i) the difference between the fair market value of a share on the date of exercise over the exercise price by (ii) the number of exercised shares. The company may pay the appreciation in cash, in shares, or in some combination thereof. The term of a stock appreciation right will be set forth in the award agreement but will not be more than 10 years. The terms and conditions relating to NanoString'sthe period of exercise following a cessation of service with respect to options described above also apply to stock appreciation rights.

Performance Units and Performance Shares

Performance units and performance shares may also be granted under the Plan. Performance units and performance shares are awards that will result in a payment to a participant only if the performance goals or other vesting criteria (if any) the Administrator may establish are achieved or the awards otherwise vest. Each award of performance units or shares granted under the Plan will be evidenced by a written or electronic agreement between the company and the participant specifying the performance period and other terms and conditions of the award, consistent with the requirements of the Plan. Earned performance units and performance shares will be paid, in the sole discretion of the Administrator, in the form of cash, shares (which will have an aggregate fair market value equal to the earned performance units or shares at the close of the applicable performance period), or in a combination thereof. The Administrator may set vesting criteria based upon continued employment or service, the achievement of specific

| | | | | | | | |

| NanoString Technologies, Inc. | 38 | 2022 PROXY STATEMENT |

performance objectives (company-wide, departmental, divisional, business unit or individuals goals (including, but not limited to, continued employment or service)), applicable federal or state securities laws, or any other basis determined by the Administrator in its discretion, and which, depending on the extent to which they are met, will determine the number and/or the value of performance units and performance shares to be paid out to participants.

After the grant of a performance unit or performance share, the Administrator, in its sole discretion, may reduce or waive any performance objectives or other vesting provisions for such performance units or shares. Performance units will have an initial value established by the Administrator on or before the date of grant. Each performance share will have an initial value equal to the fair market value of a share on the grant date. A participant will forfeit any performance shares or units that are unearned or unvested as of the date set forth in the award agreement.

Non-Employee Director Limitations

The Plan provides, in any fiscal year, that no non-employee director may be granted equity awards (the value of which will be based on their grant date fair value determined in accordance with GAAP) and be provided any cash retainers or annual or meeting fees for service as a non-employee director in amounts that, in the aggregate, exceed $750,000, except that such amount will be increased to $1,000,000 in the fiscal year of his or her initial service as a non-employee director. Any equity awards or other compensation provided to an individual while he or she was an employee, or while he or she was a consultant but not a non-employee director, will not count for purposes of these limitations.

Dividends

Dividends or other distributions payable with respect to shares subject to equity awards will not be paid before and unless the underlying shares vest, and will be subject to the same forfeitability provisions as the underlying shares. No dividends or other distributions will be paid with respect to shares that are subject to unexercised options or stock appreciation rights, although this rule will not preclude the Administrator from exercising its powers and authority under the adjustment, liquidation and merger and change in control provisions of the Plan.

Transferability of Awards

Unless determined otherwise by the Administrator and subject to the terms of the Plan, awards granted under the Plan generally are not transferable other than by will or by the laws of descent and distribution, and all rights with respect to an award granted to a participant generally will be available during a participant’s lifetime only to the participant.

Dissolution or Liquidation

In the event of the company’s proposed dissolution or liquidation, the Administrator will notify each participant as soon as practicable before the effective date of such proposed transaction. An award will terminate immediately before consummation of such proposed action to the extent the award has not been previously exercised or vested.

Change in Control

The Plan provides that, in the event of a merger of the company with or into another corporation or entity or a “change in control” (as defined in the Plan), each award will be treated as the Administrator determines without a participant’s consent, including, without limitation, that (i) awards will be assumed, or substantially equivalent awards will be substituted, by the acquiring or succeeding corporation or its affiliate with appropriate adjustments as to the number and kind of shares and prices; (ii) upon written notice to a participant, that the participant’s awards will terminate upon or immediately before the consummation of such merger or change in control; (iii) outstanding awards will vest and become exercisable, realizable or payable or restrictions applicable to an award will lapse, in whole or in part, before or upon consummation of such merger of change in control, and, to the extent the Administrator determines, terminate upon or immediately before the effectiveness of such merger or change in control; (iv) (A) the termination of an award in exchange for an amount of cash and/or property, if any, equal to the amount that would have been attained upon the exercise of such award or realization of the participant’s rights as of the date of the occurrence of the transaction (and, for the avoidance of doubt, if as of the date of the occurrence of the transaction the Administrator determines in good faith that no amount would have been attained upon the exercise of such award or realization of the participant’s rights, then such award may be terminated by the company without payment), or (B) the replacement of such award with other rights or property selected by the

| | | | | | | | |

| 2022 PROXY STATEMENT | 39 | NanoString Technologies, Inc. |

Administrator in its sole discretion; or (v) any combination of the foregoing. In taking any of the actions permitted by the Plan, the Administrator will not be obligated to treat all awards, all awards held by a participant, all awards of the same type, or all portions of awards, similarly in the transaction.